Read next

The latest news, updates and expert views for ambitious, high-achieving and purpose-driven homeowners and property entrepreneurs.

Labour promised to "get Britain building again" with 1.5 million new homes.

Twelve months later, they're on track to miss this target by more than seven years.

That stark reality should stop anyone in the property sector dead in their tracks. Not because Labour has failed entirely - quite the opposite.

The past year has delivered the most comprehensive planning reform in decades (including new Green Belt rules), systematic policy implementation, and genuine structural change to how Britain approaches housing delivery.

But here's what industry veterans know: policy momentum and delivery performance are two entirely different beasts.

And right now, the gap between Labour's ambitious framework and actual bricks-and-mortar reality represents both the biggest opportunity and the most significant risk facing property investors and developers today.

If you're making investment decisions based on headline promises rather than implementation data, you're building your strategy on quicksand.

Here, we share our expert analysis, cutting through the political noise and revealing what's actually happening on the ground - and what it means for your next move.

Let's start with the mathematics that should be driving every conversation in boardrooms across the property sector.

These figures aren’t speculative, they’re based on Energy Performance Certificate (EPC) registrations, one of the most reliable indicators of new home completions.

In the year to March 2025, just 205,000 new homes were registered, down from 212,000 in the year to December 2024 and 226,000 in the year to March 2024. That’s a 20% decline from recent peak levels.

Council taxbase data reinforces this trend. According to figures released in November 2024, England saw an increase of 213,000 dwellings in the year to September 2024, down from 237,000 over the same period the previous year.

Further, only around 245,000 homes gained full planning consent in 2024, well below the 370,000 annual approvals Labour now needs to meet its delivery goals. That’s a 34% shortfall, underscoring the growing gap between political ambition and on-the-ground outcomes.

The HBF adds vital historical context: planning permissions are now 40% below peak levels, with less investment in new housing sites than during the Global Financial Crisis or COVID-19 lockdowns.

For investors, the implications are clear. Overall delivery may be faltering, but within the wider slowdown, specific reforms are creating pockets of opportunity.

The key is knowing which ones are actually moving forward and which remain stuck on paper.

To understand where opportunities lie, you need to grasp how systematically Labour has approached reform. This wasn't scattergun policy-making - it was methodical restructuring.

The market response was telling. Planning applications in areas with revised housing targets began increasing almost immediately, with some developers reporting 15-20% upticks in pre-application discussions.

This wasn't just bureaucratic shuffling. The NPPF changes introduced formal definitions for ‘Grey Belt’ land - previously developed sites within Green Belt boundaries that don't strongly contribute to Green Belt purposes.

Suddenly, over 11,000 potential development sites gained theoretical development potential.

For landowners, this represented the most significant policy shift since the original Green Belt designation in 1955, with the ability to gain planning permission on the Green Belt more possible than ever before.

The Bill streamlines infrastructure consent, introduces strategic planning boards, and establishes new mechanisms for compulsory purchase reform.

For developers working on large-scale projects, the implications are transformational.

Labour's Grey Belt strategy deserves particular attention because it represents both the policy's greatest potential and its most significant implementation challenge.

Here's what we've observed in practice: councils are adopting "perfect or perish" validation policies as their primary workload management tool.

For developers, this means applications that could previously pass on technical merit now require solicitor-level documentation quality from day one.

The practical implication? Grey Belt opportunities exist, but they demand significantly higher upfront investment in planning preparation than traditional greenfield sites.

Labour's golden rules for Grey Belt development include:

For volume housebuilders accustomed to 20-30% affordable housing requirements, this represents a fundamental shift in development economics.

But for investors focused on build-to-rent or affordable housing sectors, it creates competitive advantages.

The Planning and Infrastructure Bill represents the most comprehensive planning reform since 1947, but its practical implications vary dramatically depending on your position in the market.

The introduction of strategic planning boards enables cross-boundary planning for the first time in decades.

For developers working on large-scale projects that cross local authority boundaries, this removes a historically complex barrier.

Local planning committees must now undergo mandatory training, addressing a longstanding industry frustration about inconsistent decision-making.

Our experience suggests this could reduce the number of officer-recommended approvals overturned by committees, currently running at around 15-20% in some authorities.

Councils can now set their own planning fees, theoretically addressing the £362 million annual deficit in planning departments.

Early indicators suggest fees could increase by 30-50% in high-demand authorities, creating cost barriers for marginal schemes.

Labour's May 2025 SME builder support package represents Britain's first serious attempt to learn from successful international models.

The statistics driving this policy shift are compelling:

Further, Only 13% of SME builders believe the government's current approach to housing and planning is positive for first-time buyers, down dramatically from 39% in 2022.

On this note, a recent PublicFirst study referenced in the HBF report found that just 27% of people aged 25–34 now own a home - down from 59% in 1997. This collapse in ownership underpins much of Labour’s urgency around affordable housing reform and helps explain the shift toward direct public sector delivery.

The headline grabber- 5-week planning decisions for small builders - sounds revolutionary until you examine the implementation detail.

The financial support element shows more promise.

Interest-only construction loans up to £10 million per firm, specifically designed for SME builders, address genuine capital constraints.

Labour's reforms aren't creating uniform opportunities across the country. Regional analysis reveals significant variations in both policy impact and delivery potential.

The North East has been particularly affected by Labour's revised housing need calculations.

Most local authorities in the region have seen sharp rises in assessed housing need, with Redcar and Cleveland experiencing an extraordinary 1,151% increase.

London's housing target has increased to 81,000 new homes annually, up from 62,000 - a 30% increase in an already constrained market.

The South East contains the highest concentration of identified Grey Belt sites but also the strongest political resistance to Green Belt development.

Labour's affordable housing programme represents the most significant policy shift from pure market delivery to state intervention in decades.

The recently announced £39 billion affordable homes programme targets 300,000 affordable and social homes over the next decade, with 180,000 designated for social rent (60% of total).

Councils can now retain 100% of Right to Buy receipts, while discounts are being reduced to protect existing stock.

The Planning and Infrastructure Bill's infrastructure provisions address a fundamental constraint that's historically limited development scalability.

The shift to prioritising grid connections for projects ready to proceed removes a major bottleneck that's delayed numerous developments.

Faster approvals for road, rail, and public transport projects should support housing development scalability, but implementation timescales remain extended.

Beyond official statistics, market intelligence reveals how Labour's reforms are affecting real-world decision-making.

Large housebuilders report increased confidence in medium-term delivery pipelines, but continue to cite skills shortages and supply chain constraints as primary limitations.

Landowners in Grey Belt areas are increasingly engaging architects and planning consultants for site assessment, but actual promotion activity remains limited pending clearer implementation guidance.

Build-to-rent investors are showing increased interest in areas with revised housing targets, particularly where infrastructure investment is confirmed.

Despite comprehensive policy reform, the fundamental skills shortage continues to limit delivery scalability.

Current industry analysis shows:

Labour's planning reforms address system efficiency but don't directly tackle skills shortages. This creates a bottleneck where policy enables development but delivery capacity remains constrained.

UK housing remains expensive yet sub-par and the push for 300,000 new-build homes risks deepening that imbalance rather than fixing it.

Labour's ambitious targets face genuine fiscal constraints that affect both policy sustainability and market dynamics.

Consecutive interest rate rises have:

Market response: Development viability is increasingly marginal for all but the most attractive sites, concentrating activity in proven locations with strong demand fundamentals.

The £22 billion fiscal shortfall Labour inherited affects programme funding beyond headline commitments.

Based on twelve months of implementation evidence, success in Labour's next phase depends on specific factors rather than overall policy direction.

The Bill's parliamentary progress through 2025 will determine whether current reforms represent foundational change or interim measures.

A crucial element of the government’s ambitious housebuilding plans is the creation of a wave of new towns, inspired by Clement Attlee’s post-war initiative that delivered over one million homes in just six years.

Each of these new towns is expected to deliver at least 10,000 homes, with a minimum of 40% designated as affordable housing, ensuring the developments meet real social need, not just market demand.

The New Towns Taskforce is required to publish a shortlist of candidate sites by July 2025. Their ability to do so - and to quickly progress from identification to delivery - will be a key test of the government’s credibility and the broader viability of its housebuilding strategy.

Success ultimately depends on local authority planning departments gaining resources and expertise to implement reforms effectively.

For property investors and developers, Labour's first year creates a bifurcated opportunity landscape.

Honest risk assessment requires acknowledging potential failure modes in Labour's approach.

Local election results and policy U-turns could disrupt reform continuity, particularly if delivery shortfalls become politically damaging.

Interest rate volatility and inflation could undermine development viability faster than planning reforms improve delivery capacity.

The gap between policy ambition and local authority delivery capability could prevent reforms translating into actual development opportunities.

Through twelve months of Labour's planning revolution, our experience at Urbanist Architecture has provided unique insights into how reforms translate into practical project delivery.

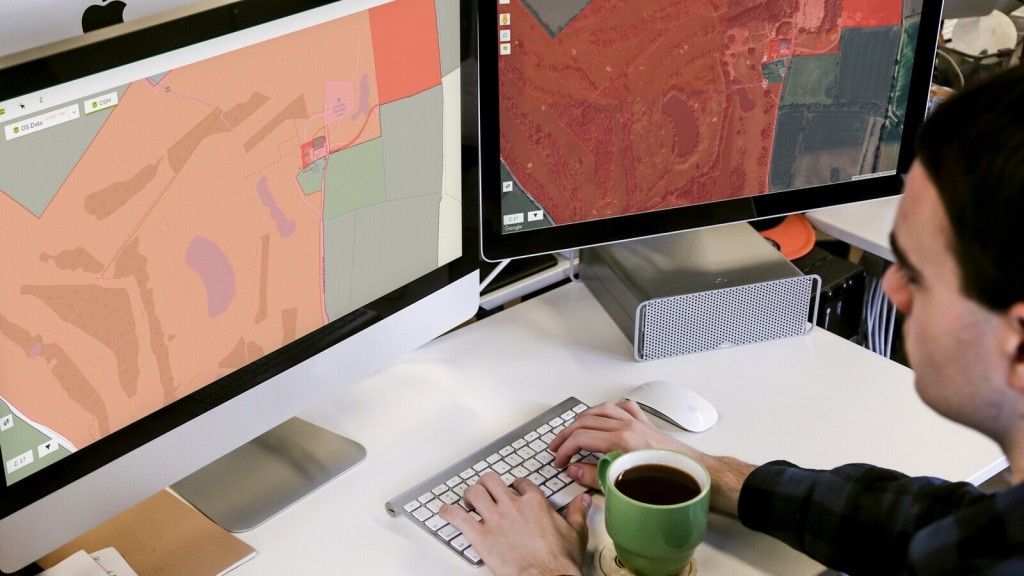

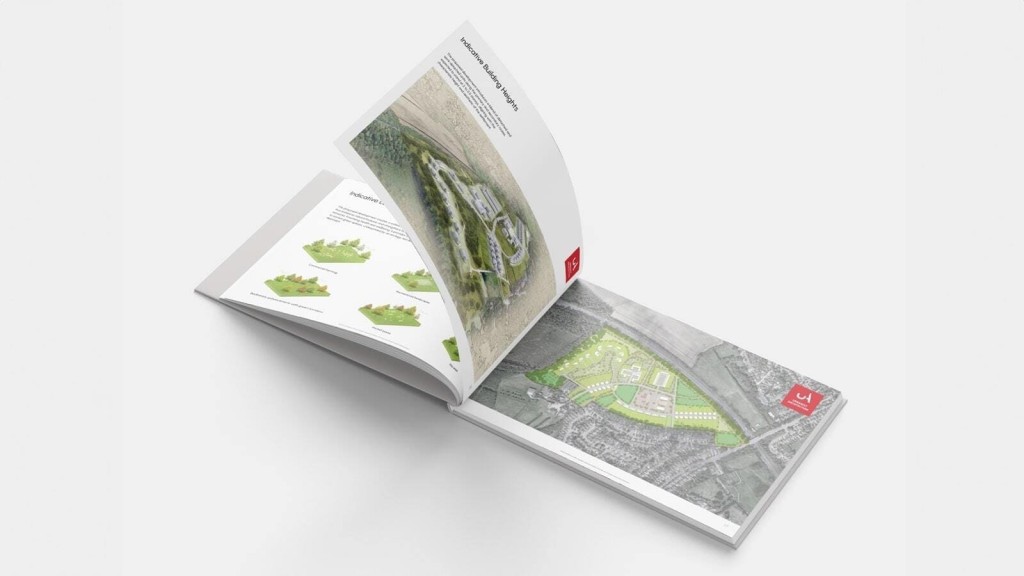

We've successfully navigated Green Belt planning for years, giving us particular insight into how Labour's Grey Belt reforms affect real projects. Our 2024 book, 'Green Light to Green Belt Developments', anticipated many of the changes we're now seeing implemented. We have also developed our own Grey Belt assessment tool designed to help landowners establish if their land is likely to be reallocated as Grey Belt.

The complexity of Labour's reformed planning system means professional expertise is more valuable than ever.

Councils implementing new procedures, revised validation requirements, and updated assessment criteria create both opportunities and pitfalls.

Labour's second year will determine whether their reforms represent transformational change or ambitious overreach.

Beyond headline housing numbers, key indicators include:

For investors and developers positioning for Labour's second year:

After twelve months of Labour's housing reform programme, the evidence is clear: this government has delivered the most comprehensive planning policy changes in decades, but delivery performance remains fundamentally constrained by structural factors beyond policy control.

For property investors and developers, this creates a nuanced opportunity landscape.

Labour's reforms are creating genuine development opportunities, streamlining processes, and providing policy certainty. But they're not solving skills shortages, infrastructure constraints, or economic headwinds.

Success requires understanding where Labour's policies are delivering practical benefits versus where they remain aspirational.

The winners will be those who can navigate policy complexity, identify implementation hotspots, and build delivery capability faster than the broader market.

Labour's ambitious promise of 1.5 million homes may take more than seven years rather than five to deliver. But for investors positioned correctly, that extended timeline represents opportunity rather than disappointment.

The question isn't whether Labour will hit their targets on schedule - the evidence suggests they won't. The question is whether you can profit from the policy changes they're implementing while managing the risks of their over-ambitious timeline.

As a practice providing architectural and town planning services for a wide range of new build homes across the UK, and after analysing twelve months of policy evolution, implementation evidence, and market response, our assessment is clear: Labour's planning reforms offer genuine opportunities for sophisticated investors, but success requires professional expertise, careful risk assessment, and realistic expectations about delivery timescales.

The housing crisis isn't solved yet, but the policy framework for solving it is finally in place. That creates value for those who understand how to access it.

At Urbanist Architecture, we've been at the forefront of planning reform analysis and implementation throughout Labour's first year in power.

Our multidisciplinary practice of architects, planners, and interior designers, based in Greenwich, has successfully navigated the reformed planning system for clients across the UK.

Whether you're a landowner looking to understand Grey Belt opportunities, a developer seeking to capitalise on planning reform, or an investor evaluating Labour's policy impacts on your portfolio, our expertise in both policy analysis and practical implementation can help you make informed decisions.

From our comprehensive book 'Green Light to Green Belt Developments' to our hands-on project delivery in the reformed planning environment, we combine strategic insight with practical experience.

If you'd like to discuss how Labour's planning reforms affect your specific project or investment strategy, don't hesitate to get in touch with our team. In a rapidly evolving policy landscape, professional expertise isn't just valuable - it's essential.

Nicole I. Guler BA(Hons), MSc, MRTPI is a chartered town planner and director who leads our planning team. She specialises in complex projects — from listed buildings to urban sites and Green Belt plots — and has a strong track record of success at planning appeals.

We look forward to learning how we can help you. Simply fill in the form below and someone on our team will respond to you at the earliest opportunity.

The latest news, updates and expert views for ambitious, high-achieving and purpose-driven homeowners and property entrepreneurs.

The latest news, updates and expert views for ambitious, high-achieving and purpose-driven homeowners and property entrepreneurs.

We specialise in crafting creative design and planning strategies to unlock the hidden potential of developments, secure planning permission and deliver imaginative projects on tricky sites

Write us a message