Read next

The latest news, updates and expert views for ambitious, high-achieving and purpose-driven homeowners and property entrepreneurs.

Turning policy into profit is not new. In the Green Belt, however, the sums are extraordinary. Ask a farmer on London’s edge what one planning consent is worth and you will hear the same story. Land valued for barley one year is valued for bedrooms the next. That is the planning permission “lottery”, and it is why Green Belt decisions go straight to the hard questions of housing supply, infrastructure and fairness.

The scale is not incremental. In one case, a field worth about £22,500 per hectare leapt to £6.2 million with residential permission. It’s a 275-fold jump. More broadly, Green Belt farmland that trades around £21k/ha can climb to £1.95–£2.4m/ha once buildable.

Proximity to jobs and rail intensifies the effect, but the underlying driver is policy-created scarcity. That is why land value capture sits at the centre of today’s reform agenda and will remain there well into the future. The question is no longer whether uplift exists. It is how much of it is converted into public benefit.

Before we go any further, here is a short clip from my Sky News Live interview. It summarises the practical reality behind the Green Belt debate. Why the term is so often misunderstood, what Grey Belt is designed to do in practice, and why schemes refused locally on perception grounds are frequently allowed on appeal once policy and evidence are applied as intended.

With that context, the link to land value uplift is simple. The biggest jumps happen when policy shifts a site from protected by default to eligible in principle. That shift may happen through plan-led Green Belt review, the new Grey Belt gateways, or an appeal decision that corrects an overly political refusal. Once planning risk collapses, residential values become the benchmark, and the windfall crystallises.

The draft NPPF 2025 signals a tougher deal on what happens next. Tighter viability, benchmark-led land values, and Golden Rules intended to push more uplift into affordable housing, infrastructure and green space. But policy wording is not delivery. Until plans allocate at pace and obligations are enforced consistently, Green Belt scarcity will continue to inflate hope value and keep upward pressure on housing prices for the foreseeable future.

In this article, we unpack the mechanics behind those headline-grabbing uplifts with the Green Belt planning permission, show where and why they’re most extreme, and explain how the new framework is designed to turn private windfalls into public value.

The real driver is planning approval to build homes instead of growing crops.

When Green Belt land switches from agricultural use to residential development, you're not just changing what happens on the plot, you're unlocking access to markets where housing demand far outstrips supply in cities like London and beyond.

The gap between farm value and housing value isn't gradual. It's a cliff edge that scarcity makes even steeper.

Everyone assumes property development rewards the hardest workers or smartest investors. The Green Belt proves otherwise.

These sites sit next to high-demand urban areas where residential land values dwarf agricultural returns by extraordinary margins. The difference between what land is worth for farming versus housing represents one of the largest value gaps in the UK economy.

The fact is, only a small share of Green Belt plots ever secure planning permission or release. When one does, the value can jump dozens to hundreds of times - a policy-created windfall without any physical change to the land. That's why it's often described as a lottery for landowners and a fairness issue for communities.

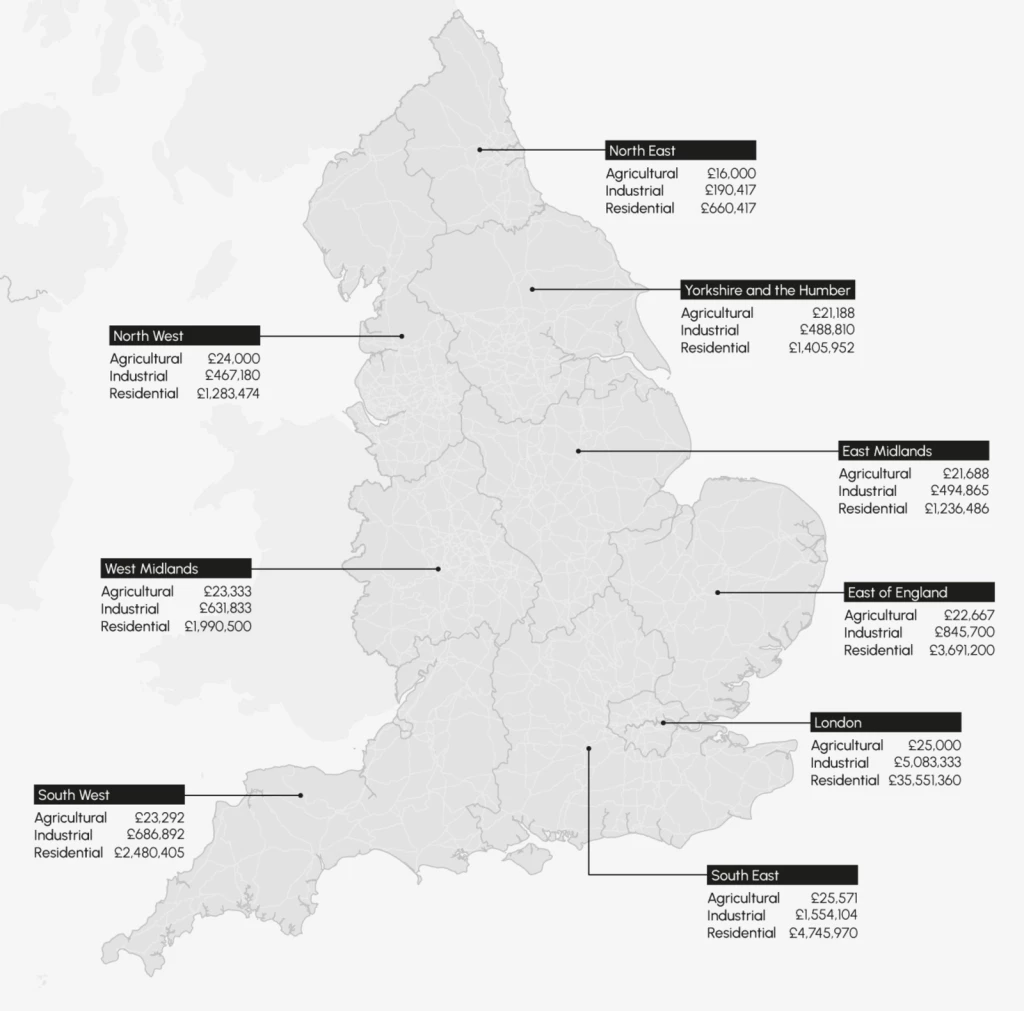

Current evidence places average farmland around £20,000-25,000 per hectare (£8,200 per acre), with prime arable land reaching £24,500 per hectare (£9,900 per acre).

Values vary significantly by region and land quality, with some areas like the South West seeing grade 3 arable land increase by 5.7% while eastern regions experienced declines.

Green Belt farmland near London continues to command premium prices due to proximity and development hope value, typically sitting at the upper end of these ranges.

The housing development market tells a different story entirely.

Based on our analysis of recent Savills and industry data, residential development land values remain broadly stable, with greenfield land showing minimal change. Our review of policy appraisal benchmarks indicates £2-3 million per hectare for housing land in many non-London authorities.

Analysis of current market data suggests that in London and prime commuter belt locations, values reach £5-10 million per hectare and significantly higher in premium zones. Our assessment of urban brownfield land shows values have declined by 2.3% annually, reflecting viability challenges and reduced appetite for high-density residential schemes across all regions.

The mathematics of planning permission remain as stark as ever.

Broadly similar in order of magnitude to the historical figures, around 100x is still a sensible rule of thumb in high-demand commuter locations, with outliers above and below depending on site specifics and planning obligations.

Based on the sources we've reviewed and analysed, the Centre for Progressive Policy (2018) found an uplift of about 275x (from £22,520/ha to £6.2m/ha), CPRE (2018) reported roughly 108x (from £22,300/ha to £2.4m/ha using MHCLG/DLUHC figures), and the Housing, Communities & Local Government Committee (2018) identified around 93x (from £21,000/ha to £1.95m/ha, excluding London).

Bringing these together, our analysis is that a ~100x uplift is a robust rule of thumb nationally, with higher multiples closer to London and major commuter corridors. The exact figure still hinges on location, achievable density, infrastructure and affordable housing requirements, site “abnormals”, and market timing.

Allocation via the local plan typically crystallises most of the development value uplift because planning risk premium collapses. Sites that enter early through the call for sites process and are carried forward at Regulation 18 consultation stand the best chance of allocation.

In those cases, a common pattern is farmland worth roughly £20–40k per hectare re-rating towards £2–3m per hectare outside London, and higher around London’s commuter belt. As a result, a ~100x uplift remains a sensible rule of thumb, subject to density, obligations and site constraints.

In exceptional, high-value locations (or unusually efficient densities), outturns can move beyond that; historic benchmarks span ~93x to ~275x.

If you secure consent without prior allocation, via the Grey Belt route or by a very special circumstances case, the leap can be even more pronounced because you capture the entire agricultural-to-residential step in one go, provided the scheme meets affordability and infrastructure demands.

Conversely, tougher obligations, lower densities, awkward access or heavy site constraints will pull the residual down. In 2025, expect appraisals to be tested against benchmark land values, so the uplift is only bankable where bids align with policy from day one.

Most farmland trades based on what crops it can grow. But near cities, a different calculation takes over.

Hope value is the premium paid above pure agricultural worth in anticipation of future planning change. It's the extra money buyers willingly pay today for land that might, someday, get planning permission for a new build house or multiple houses. Near cities or transport hubs, buyers may pay several times farm value on the gamble that policy will eventually shift in their favour.

This creates a distortion that ripples through entire regions. Landowners start pricing their fields not on farming potential, but on development dreams. Estate agents market "land with potential" rather than productive agricultural assets. The speculation inflates expectations and land costs long before any permission is granted, or even applied for. This planning premium effect transforms working farmland into speculative assets.

The effect compounds over time. Each sale at inflated prices becomes comparable for the next transaction, ratcheting up baseline values across whole districts. Agricultural businesses find themselves priced out of expansion opportunities, while speculators circle promising locations. Hope value transforms working farmland into a financial instrument, where the crop yield matters less than the planning committee's next decision.

The Green Belt's lottery effect isn't evenly distributed. In fact, it clusters around the places where housing demand hits hardest against planning restrictions.

The most dramatic hope values appear in commuter belt locations where three factors converge: excellent transport links to London, severe housing shortages, and tight Green Belt boundaries that make any release extraordinarily valuable.

These areas create the perfect conditions for speculative premiums, where farmland trades at multiples of agricultural value based purely on development potential.

The Green Belt rules of the game are changing, and fast.

The policy mood has shifted dramatically. Authorities are now expected to review Green Belt boundaries where it's necessary to meet proven needs, rather than treating them as entirely untouchable. This isn't just guidance, it's becoming the new orthodoxy across planning departments.

At the same time, the government's "Golden Rules" push releases to deliver more public value: higher-than-usual affordable housing, up-front infrastructure and better green space baked in from the start. The days of minimal community benefit are ending.

Viability is being anchored to benchmark land values. This means that these schemes are judged against policy-assumed land prices, not whatever a promoter happened to pay. This cuts off the "overpay then dilute obligations" playbook that developers have relied on for years.

There's also active work on compulsory purchase and "hope value", with proposals to limit compensation for speculative expectations. The goal is letting public bodies assemble land closer to existing use value when that's the right tool, rather than paying inflated prices driven by development dreams.

They flip the entire conversation on its head.

Benchmarks reset the conversation at source. The local plan or guidance states a policy-assumed land price for viability, so the appraisal tests your scheme against that figure rather than whatever you agreed with a landowner.

If you overpay, the benchmark still applies, meaning affordable housing, infrastructure, and green space requirements do not shrink to make your deal work. Instead, the residual land value must flex to accommodate policy requirements, preventing the land value increment from being captured privately.

Practically, this pushes promoters to structure options and conditional contracts around benchmark-compliant values, align densities and typologies with policy, and bring “abnormals” and mitigation forward early. The net effect is fewer late "viability reopeners" and clearer, faster negotiations.

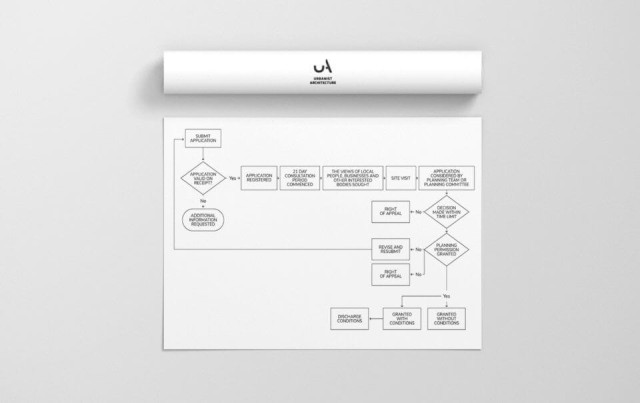

They operate at different stages and answer different questions.

Exceptional circumstances are a plan-making test: the council must show, through evidence, that altering Green Belt boundaries is necessary to meet identified needs and cannot be achieved reasonably elsewhere. This happens at the strategic level when councils write their local plans.

Very special circumstances are a decision-taking test at the application stage. Even if development is inappropriate in the Green Belt, the benefits must clearly outweigh the harm to openness and any other harm. This is about individual planning applications.

The key difference?

Exceptional circumstances are strategic and rarely about a single site in isolation. In fact, it's about whether the Green Belt boundary should move at all. Very special circumstances are site-specific, balancing design quality, need, public benefits and mitigation against Green Belt harm for one particular proposal.

They are the levers that convert planning-created uplift into public benefit.

Section 106 secures affordable housing and site-specific works (schools, junctions, open space). CIL (where charged) funds wider infrastructure across a charging authority area. The Infrastructure Levy, where piloted or introduced, seeks to link contributions more directly to development value.

In viability terms, these planning obligations are treated as costs deducted from Gross Development Value (GDV before arriving at land value. Strong, plan-led requirements therefore lower the residual available for land, encouraging realistic land bidding, benchmark-compliant options and fewer post-permission attempts to dilute affordable housing or contributions.

Affordable housing is a principal driver in the residual calculation. Increase the proportion or deepen the discount, and the developer's receipts fall, all else equal. Because developer profit, build costs, fees and finance are relatively inflexible, the adjustable item is usually land value.

In a benchmark-led system, bidders price land on the basis of meeting the policy target, not on the hope of reducing it later. The reverse also holds: if policy lowers the requirement or allows tenure mix that boosts receipts, the residual for land rises. Hence, early clarity on percentages, tenures and review mechanisms is essential to avoid mis-pricing.

Abnormals are extraordinary or site-specific costs that sit on top of standard build rates: ground remediation, piling, utilities diversions, flood attenuation, complex access, acoustic walls, or extensive ecological mitigation. Each abnormal slices into the scheme surplus before land value.

This means a site with heavy abnormals must either support higher sales values, higher densities, or accept a lower land price to remain viable while still meeting policy asks. In Green Belt locations, promoters often trade the relative ease of edge-of-town logistics against potential strategic infrastructure (e.g., new junctions or SANG) and the Green Belt policy tests, which can also carry cost.

Grey Belt is land within Green Belt boundaries that either contains previously developed sites or makes limited contributions to three of the five main Green Belt purposes. Development here is not "inappropriate" if four tests in paragraph 155 of the revised NPPF are met: demonstrable need, sustainable location, limited harm, and compliance with Golden Rules.

In fact, development on Grey Belt land that meets appropriateness tests is no longer considered "inappropriate" in Green Belt terms, sidestepping the usual "very special circumstances" hurdle entirely.

But there's a trade-off: Grey Belt development must meet the Golden Rules which include policy-level affordable housing, necessary infrastructure improvements, and enhanced public green space. The same value-capture expectations apply, with benchmark land values preventing inflated deals that hollow out public benefit.

The catch?

The House of Lords Built Environment Committee concluded Grey Belt policy is "unlikely to make any significant difference to the number of new homes that can be built." Early evidence shows different authorities taking varying approaches to assessment.

It doesn't switch Green Belt policy off entirely, but it can be the key that unlocks consent when wielded through the right policy route.

That’s because the NPPF’s presumption in favour of sustainable development still applies, even in the Green Belt, but only when balanced carefully against the strong protections afforded to openness and countryside character.

The mechanics are clearer now than they've ever been, with two distinct pathways emerging from recent appeal decisions.

The Smallfield decision in Tandridge (June 2025) maps out the first pathway. Here, the Inspector worked through paragraph 155 of the revised NPPF, establishing the site as "Grey Belt" (previously developed land within Green Belt boundaries where the usual restrictions don't bite as hard).

With Tandridge sitting on just 1.92 years' housing supply and a Housing Delivery Test result of 42%, the Inspector accepted there was "demonstrable unmet need." The site's sustainable edge-of-village location helped, but what sealed the deal was full compliance with the Golden Rules: 49% affordable housing, comprehensive flood alleviation, highway improvements, and substantial new public green space.

The crucial distinction?

Because the development wasn't deemed "inappropriate" for Green Belt purposes, the usual harm test and "substantial weight" against development simply didn't apply. Permission followed almost inevitably.

The Borehamwood appeal in Hertsmere (November 2024) demonstrates the second pathway.

One that's harder but still viable when the numbers stack up.

Unlike Smallfield, this proposal remained "inappropriate" Green Belt development, triggering the full very special circumstances test. But with housing supply at just 1.36 years, acute affordable housing need, and the developer offering 50% affordable homes, the Inspector gave these factors "very substantial weight" in the balance.

The accessible, rail-served location mattered too, as did Hertsmere's stalled plan-making process and the likelihood that Green Belt releases would prove necessary anyway. With 220 homes approved, the benefits clearly outweighed the harm.

The lesson cuts straight to strategy: a five-year housing land supply shortfall won't bulldoze through Green Belt policy on its own, but it can unlock consent through two proven routes.

Either it provides evidence of unmet need on Grey Belt sites under paragraph 155, bypassing the inappropriate development test entirely. Or it carries decisive weight in a very special circumstances case, tipping the balance toward approval.

Across a range of Grey Belt appeal examples, Inspectors have adopted exactly these approaches, so this is not unusual in practice.

The non-negotiable element in both routes is clear: policy-level affordable housing, substantial infrastructure contributions, and genuinely sustainable locations. Without these, even severe supply shortfalls will not shift the dial. With them, Green Belt consent moves from possible to plausible.

Start with what completed homes will sell for - that's your GDV. Subtract construction costs, fees, finance, developer profit, and crucially, all policy requirements like affordable housing and Section 106 contributions.

What's left is the residual land value which is the maximum you can pay for the site while meeting policy and achieving commercial returns. If obligations increase or sales values soften, the residual must fall; policy requirements shouldn't flex to accommodate overpaying.

This is why benchmark land values matter in 2026. They anchor calculations to policy-compliant assumptions from day one. The old playbook of overpaying land then "fixing it later" by trimming affordable housing is closing fast. Professional developers now structure offers around residual valuations that work with full policy compliance, not despite it.

Absolutely. Both directly through achievable values and indirectly through planning risk and delivery speed.

Well-designed, transit-oriented developments command higher densities, faster sales rates, and stronger prices per square foot. That lifts GDV without inflating land costs. The 2025 planning reforms explicitly strengthen design quality requirements, giving local authorities more power to reject substandard schemes.

Centre for Cities research shows that releasing Green Belt land within 800 metres of rail and tube stations around London could unlock over 1.1 million homes with direct access to city centre jobs. Proximity to sustainable transport doesn't just support higher land values. In fact, it's becoming a prerequisite for securing consent.

Conversely, car-dependent layouts face higher per-unit infrastructure costs, slower absorption rates, and growing policy resistance. In Green Belt locations, transport accessibility can be decisive in very special circumstances cases or Grey Belt assessments.

It can, but only if value-capture mechanics work as designed.

Recent analysis from LandTech suggests Green Belt releases in England could accommodate nearly 94,000 additional dwellings, but the benefit depends on policy implementation.

We believe Green Belt land development is key to meeting the UK's growing housing demand, but opening up land for development without a focus on financial accessibility is pointless if our goal is to solve the housing crisis

This is precisely why the new Green Belt Golden Rules requiring a minimum of 50% affordable housing provision are crucial, ensuring that development serves genuine housing need rather than private speculation.

As we explore comprehensively in our book 'Green Light to Green Belt Developments', which investigates the policy's biggest winners and losers, and explores its connections to climate change and the housing crisis, developing some of the Green Belt - only the most appropriate areas - is necessary to fulfill the housing needs of the UK's growing population.

London's draft 2025 Plan shows the right approach too: 50% affordable housing requirement for Green Belt developments, significantly higher than existing benchmarks, with strong focus on social rent homes.

Here's what makes the difference: Strategic Green Belt development, when properly implemented with robust value capture mechanisms, represents one of the most viable pathways to delivering the affordable housing England desperately needs. The 2025 framework combines benchmark land values, Golden Rules, and tighter viability tests to tilt outcomes towards genuine affordability rather than developer windfall profits.

The policy shift recognises a fundamental truth: preserving every acre of Green Belt whilst millions struggle with housing costs is neither sustainable nor socially responsible. Success will require disciplined plan-making, realistic land pricing from day one, and delivery partners prepared to meet policy requirements in full.

When executed correctly, selective Green Belt release can transform underperforming land into thriving, affordable communities that serve genuine housing need whilst maintaining the Green Belt's essential functions of preventing urban sprawl and protecting our most valuable landscapes.

Lead with evidence, be plan-led, and front-load obligations. The new Planning Practice Guidance published in February 2025 provides clearer assessment criteria, but fundamentals remain:

Structure land deals around benchmark values to capture legitimate development uplift while ensuring appraisals work without late dilution. Bring forward abnormals, biodiversity net gain, and landscape mitigation early. Use credible delivery teams and clear phasing strategies.

Most importantly: understand the planning balance is shifting toward higher public benefits and stronger design standards. What worked in 2022 may not work in 2026.

Short answer: yes, but only in tightly defined circumstances, and they are rarely a route to easy land value gains.

Paragraph 84 permits isolated countryside homes, including in the Green Belt, only where the design is genuinely outstanding, significantly enhances its setting, and meets rigorous sustainability criteria.

This is not a backdoor to Green Belt development. Expect rigorous design review, detailed materiality scrutiny and extended pre-application. Success rates are low, costs are high, and programmes are long. If you pursue this route, budget for multiple design iterations, full environmental assessments and a watertight planning case.

In English planning, major development includes housing schemes of 10+ dwellings (or where dwellings are unknown, sites ≥0.5ha), as well as non-residential proposals creating ≥1,000 m² floorspace or on sites ≥1ha. Everything below these thresholds is commonly treated as minor development.

The most demanding affordable housing and Golden Rules expectations are triggered by major development thresholds. Because national policy states that affordable housing should not be sought from residential proposals that are not major developments, sub-10-unit schemes typically avoid on-site affordable housing requirements.

However, some councils still levy commuted sums (payments in lieu), and designated rural areas can set lower thresholds, sometimes five homes or fewer. In addition, once adopted, CIL can apply to schemes of any size, so even small sites may face infrastructure charges.

Small schemes can sometimes use the Grey Belt route where the land is previously developed or makes a limited contribution to Green Belt purposes. If the location is sustainable and the proposal meets design and green space expectations, decision makers may treat it as not inappropriate.

A five-year housing land supply shortfall does not override Green Belt policy, but it can add material weight to unmet need where the other tests are satisfied. That combination can make a carefully designed sub-10 unit scheme more deliverable than a larger one.

Before you look at house types or densities, check the unseen bill. The headline risks are familiar, but it is their off-site knock-ons that drain value: highways upgrades, utility reinforcements, flood management, and tricky ground can all snowball into seven-figure commitments and early cashflow hits.

Add ecology requirements, rights-of-way changes and third-party land to the mix. Early surveys, utility capacity letters and design-led mitigation are the best defence for the residual and the planning gain.

Development viability hinges on four critical infrastructure categories that consistently drive the highest off-site costs. While these elements are predictable in type, their financial impact often catches developers off-guard. Not because of what happens within site boundaries, but due to the extensive off-site works they trigger.

Understanding and quantifying these "usual suspects" early in the appraisal process is essential for protecting development margins and avoiding late-stage cost escalation.

They set your GDV value and your obligations simultaneously. Rail-served or strong bus corridors typically support higher densities and sales values, faster absorption and lower per-home parking and road spend, which lifts viability and the land residual. Good urban design and masterplanning create walkable blocks, legible streets, landscape structure and mixed tenure that pushes values and reduces planning risk, often accelerating determination.

The trade-off is that well-connected sites also attract firmer asks - higher affordable housing percentages, stronger active-travel packages, and up-front community infrastructure. The net effect varies by location.

In the right place, density plus design quality tends to increase total planning gain and still support a healthy residual for land, because value growth outpaces cost growth. In weaker locations, extra units may depress sales or trigger disproportionate infrastructure, shrinking the residual.

In 2026, authorities expect density to follow accessibility. Arguing for low density by rail becomes a hard sell and delivers a weaker residual story.

Use structures that price to policy, share risk on unknowns, and stop late viability drift.

The harsh truth about Green Belt development is this: most applications fail spectacularly.

Those that succeed share three non-negotiable elements. The evidence is bulletproof. The design is beyond reproach. And the location genuinely serves the public interest.

This isn't luck. It's the unforgiving filter every successful Green Belt planning permission must pass.

Looking ahead to 2026 and beyond, the forces that push prices up are unlikely to disappear. Even with Grey Belt policy, Golden Rules and tighter viability language, delivery will remain the constraint. Unless councils allocate at pace and infrastructure is funded early, land stays rationed around the highest-demand places. The draft NPPF 2025 reinforces this shift in tone by signalling firmer plan-making expectations and less tolerance for viability arguments that dilute policy delivery.

In that future, the Green Belt continues to operate as a scarcity mechanism. It concentrates competition onto the small pool of sites that become eligible in principle, inflates hope value, and feeds higher residual land values into the price of new homes. The practical prediction for 2026 is blunt. Unless release and delivery materially accelerate, Green Belt constraints will remain a structural driver of housing prices for the foreseeable future, with the strongest pressure in rail-served commuter corridors where demand is deepest and supply is most tightly controlled.

Experienced developers recognise two fundamentally different routes to Green Belt returns, each with its own risk-reward profile.

The first is patience rewarded.

Formal release through Regulation 18 local plan processes transforms agricultural land into residential gold. We're talking 100x to 275x multipliers as councils officially redesignate sites. Once allocated, the planning risk evaporates and value crystallises like clockwork.

The second route? Pure audacity.

Direct planning applications bypass the queue entirely. The odds are tougher, but the upside is obvious. Landowners capture the full agricultural-to-residential leap in a single consent. There is no slow re-rating through allocation, and no gradual de-risking. It is one decisive planning outcome that crystallises the uplift.

That is why this route attracts so many national housebuilders, developers and landowners. The mathematics are compelling. Just as importantly, it gives control over timing and terms, rather than waiting on a local plan programme.

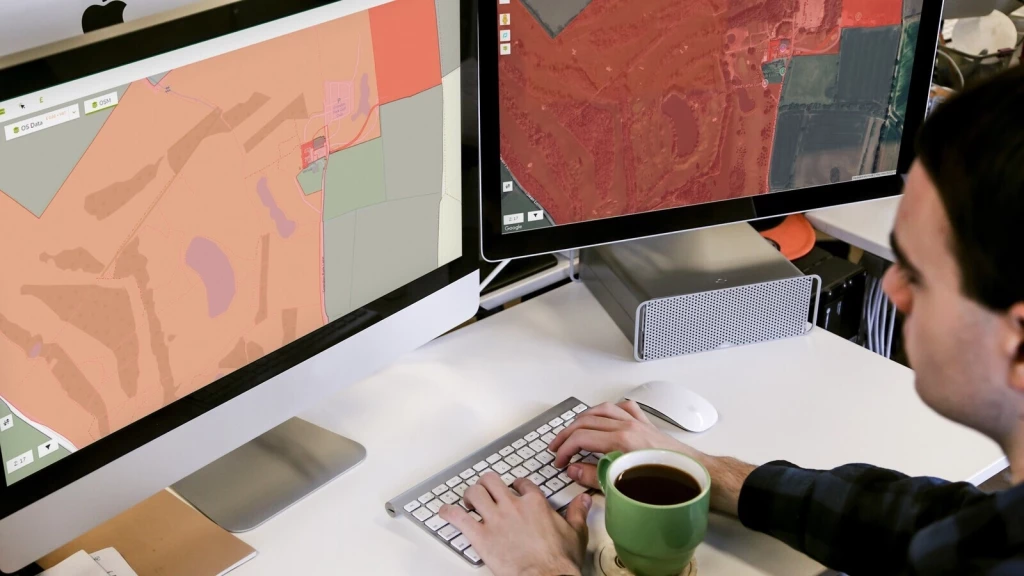

In practice, this is also the point where specialist Green Belt strategy separates success from refusal. Many of our clients instruct us specifically to pursue this uplift route on Green Belt land, and we have been consistently successful by treating the application as a structured risk exercise. We build the evidence early, shape the scheme around the policy gateways, and front-load the design and mitigation that neutralises the predictable reasons for refusal.

Developers can then move when market conditions align, when policy windows open, or when very special circumstances crystallise. They are not hostage to council timetables or political cycles. For national housebuilders managing complex land portfolios, this flexibility is invaluable. Sites can be activated when infrastructure funding becomes available, when affordable housing grant aligns, or when regeneration momentum builds nearby.

The risk premium is real, but so is the speed to market. Where local plan allocations may take five to ten years to materialise, a direct consent may unlock development within 18 to 24 months of submission. For developers carrying significant land costs, that acceleration often justifies the planning uncertainty.

Urbanist Architecture’s founder and managing director, Ufuk Bahar BA(Hons), MA, takes personal charge of our larger projects, focusing particularly on Green Belt developments, new-build flats and housing, and high-end full refurbishments.

We look forward to learning how we can help you. Simply fill in the form below and someone on our team will respond to you at the earliest opportunity.

The latest news, updates and expert views for ambitious, high-achieving and purpose-driven homeowners and property entrepreneurs.

The latest news, updates and expert views for ambitious, high-achieving and purpose-driven homeowners and property entrepreneurs.

We specialise in crafting creative design and planning strategies to unlock the hidden potential of developments, secure planning permission and deliver imaginative projects on tricky sites

Write us a message